cahaya mata sarawak

Follow and subscribe to DayakDaily on Telegram. March 14 2022 2241 pm 08.

Cahya Mata Sarawak About Sarawak

Cahya Mata Sarawak Bhd CMS today suspended its group chief financial officer CFO Syed Hizam Alsagoff for 30 days with immediate effectThe suspension is to facilitate investigations into allegations of possible financial mismanagement in relation to the companys investments and operations CMS said in a filing with Bursa.

. CMSB bermula sebagai kilang produk tunggal dari Simen Portland pada tahun 1974 untuk menjadi sebuah. Cahya Mata Sarawak Berhad CMS comprises more than 35 companies across 7 business divisions. A new Covid-19 cluster has emerged at Lorong Cahaya Maju in.

Mukhnizam Mahmud has had over 30 years of experience serving companies in Malaysia Singapore and Indonesia in both AccountingFinance and General Management. The gain on disposal that will potentially be recognised is RM1476 million. For faster news updates.

Meet the Cahya Mata Sarawak Berhad CMS Board of Directors. To conduct PESTEL PEST analysis of Cahya Mata Sarawak in the current macro environment we have analyzed Political Economic Social Technological Environmental and Legal factors that impact the business environment in which Cahya Mata Sarawak operates in. Cahya Mata Sarawak Bhd is a conglomerate that engages in businesses to further the development of Sarawak the largest state in Malaysia.

MIDF Research said Cahya Mata Sarawak Bhd CMS is making a timely exit from its ferroalloy smelting business in Sarawak. 2852 ialah sebuah konglomerat terkemuka yang tersenarai di Pasaran Utama Bursa Malaysia dan merupakan pemain sektor swasta utama di Sarawak. RM527mil disposals of subsidiaries help Cahya Mata Sarawak to exit erratic alloy smelting business.

Launch your career now. By Asila Jalil - June 15 2022 644pm. 73 rows At Cahya Mata Sarawak Berhad CMS we seek to be Sarawaks.

Cahya Mata Sarawak Details. Its core businesses which collectively account for roughly 90 of the companys total revenue are the cement division which manufactures cement clinker and concrete products. The Cahya Mata Sarawak brand valuation has featured in 10 brand rankings including the biggest Malaysia brands and the best Banking brands.

Nurturing People Sustaining Communities. About Sarawak Cable. Lotte Chemical Titan Malaysia.

Join Facebook to connect with Cahaya Mata Sarawak and others you may know. Mar 3 2022 1802. Cahya Mata Sarawak Berhad CMSB MYX.

Cahya Mata Sarawak gen5dqo50k4o. Syahrul Mortada Human Resources Executive. To find out more about Cahya Mata Sarawak brand value request the Cahya Mata Sarawak Brand Value Report.

Sean Chin Group Technology Graduate. We are the single largest and most acclaimed cable wire producer in Malaysia and South East Asia. According to Harvard Business Review 75 of the managers use SWOT analysis for various purposes such.

Total Employee Count Employee Retention. Oct 4 2020 CMS. Mukhnizam 56 has more than 30 years of experience with companies in Malaysia Singapore.

Our culture of PRIDE starts with the Board of Directors focusing on areas that are important to stakeholders. OM Materials S Pte Ltd OMS has entered into a binding letter of offer with Samalaju Industries Sdn Bhd a wholly-owned subsidiary of Cahya Mata Sarawak for it to sell all its shares held in OM Materials Sarawak Sdn Bhd and OM Materials. Cahya Mata Sarawak Berhad an investment holding company engages in the manufacturing and trading of cement and construction materials construction road maintenance township and property and infrastructure development businesses in Malaysia.

New Covid-19 cluster detected in Lorong Cahaya Mata as Sarawak logs 1206 new cases 1 death in Sibu. Awards and Recognitions. Cahya Mata Sarawak Bhd CMSB has appointed Mukhnizam Mahmud as the groups acting chief financial officer CFO effective Tuesday March 15.

CMS Doing Good Initiatives. View Cahya Mata Sarawaks full profile. CMSB dimulai sebagai sebuah pabrik produk tunggal dari simen Portland pada 1974 untuk menjadi sebuah syarikat yang memberi tumpuan kepada visi kebanggaan.

All content is posted anonymously by employees working at CAHYA MATA SARAWAK. View the profiles of people named Cahaya Mata Sarawak. Sep 20 2020 MEDIA HOLDING STATEMENT.

This is the CAHYA MATA SARAWAK company profile. Thursday 16 Jun 2022. May 18 2022 CMS posts.

Mukhnizam Mahmud The Edge filepix KUALA LUMPUR March 14. Brand Finance has calculated the brand value of the Cahya Mata Sarawak brand 10 times between 2008 and 2021. Editor - May 5 2022.

Nov 25 2020 CMS Reports PBT of RM817 Million in 3Q2020. Cahya Mata Sarawak Bhds CMSB disposal of its entire 25 per cent stakes in OM Materials Sarawak Sdn Bhd and OM. Cahya Mata Sarawak construction.

- A A. Our power cables and wires are synonymous with Quality and Reliability not just in the calibre of its products but also in its establishment as a world-class cable manufacturer. Cahya Mata Sarawak Berhad CMSB MYX.

Owing to the spike in commodity. Price-To-Earnings ratio 51x is below the MY market 145x Revenue is. We have recently acquired two 2 subsidiaries.

KUALA LUMPUR May 5. OM Holdings Offers US120 Million To Cahya Mata Sarawak For Balance 25 Stake In Smeltering Plants. Our strength of more than 2750 employees is the driving force behind our success.

Glassdoor gives you an inside look at what its like to work at CAHYA MATA SARAWAK including salaries reviews office photos and more. 2852 adalah sebuah perusahaan yang masuk Pasar Utama bursa saham Malaysia Bursa Malaysia dan merupakan pemain sektor swasta besar di Sarawak. Cahaya Mata Sarawak which manages a diversified portfolio of business from construction ICT to the property sector has appointed former Scomi Group Chief Financial Officer as its new CFO.

Working At Cahya Mata Sarawak Glassdoor

Cms In Deal With Sedc To Dispose Two Per Cent Stake In Subsidiaries

Cahya Mata Sarawak Business Divisions

Cahya Mata Sarawak Vision Mission

Cms Investigations Leads To Governance Risk Pricing

Cahya Mata Sarawak Requires Engineer Technician And General Worker

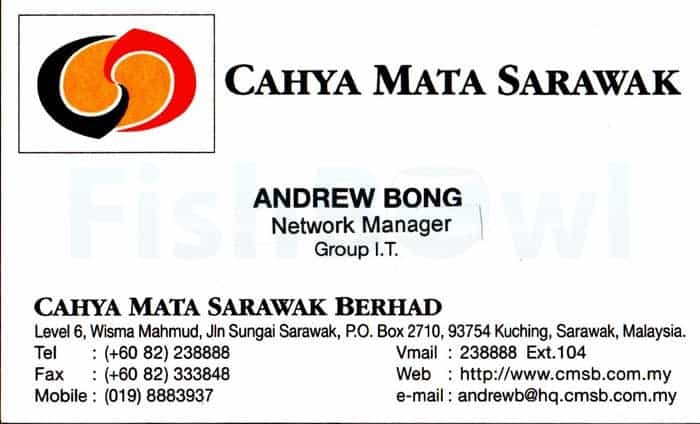

Cahya Mata Sarawak Berhad Business Card Directory In Malaysia Business Card Directory In Malaysia

Cahya Mata Sarawak S Net Profit Increased 4pc To Rm203 41 Million For Fy21

Cahya Mata Sarawak Ventures Into Energy Market Via Acquisition Of Scomi Energy S Oilfield Assets The Edge Markets

Cahya Mata Sarawak Cms Launches New Eco Friendly Portland Limestone Cement

Cms To Undertake Restructuring

Cahya Mata We Are A Monopoly But Anyone Can Supply Cement In Sarawak The Star

High Noon At Cahya Mata Sarawak Sarawak Report

Cahya Mata Sarawak Cahya Mata Sarawak Berhad Posts Record Profit

Cahya Mata Sarawak Announcements To Bursa

0 Response to "cahaya mata sarawak"

Post a Comment